ct sales tax online

Sherwood Manor CT Sales Tax Rate. Simsbury Center CT Sales Tax Rate.

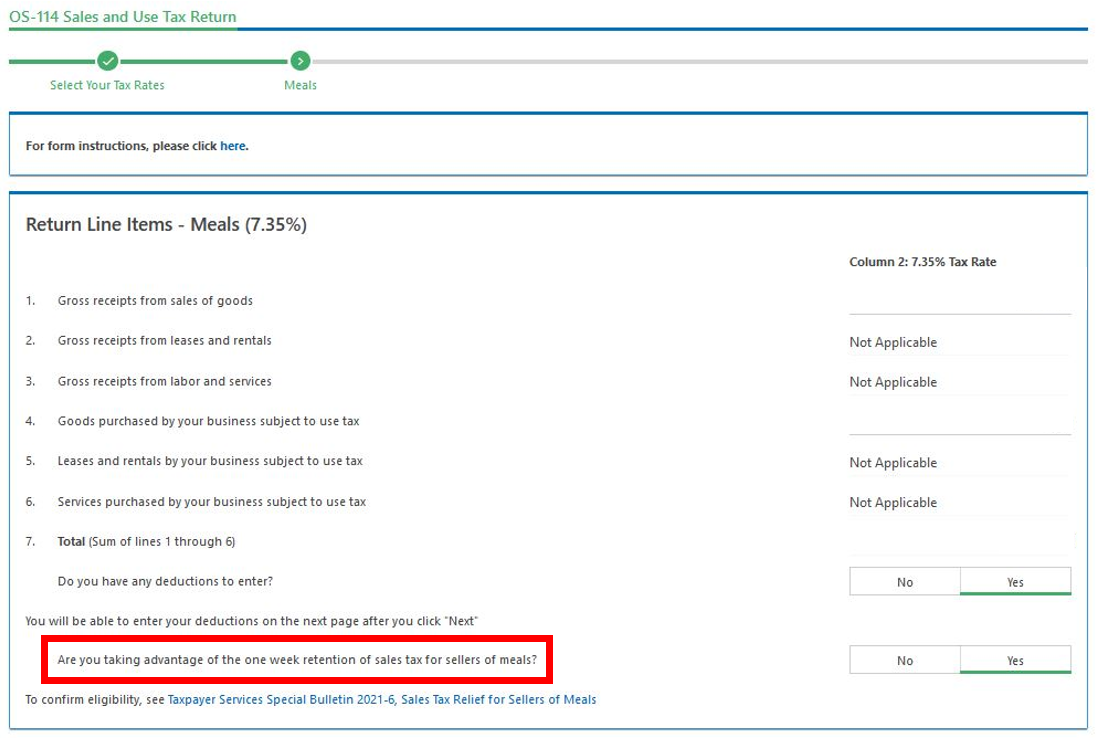

Sales Tax Relief For Sellers Of Meals

The Connecticut state sales tax rate is 635.

. Lakeridge Tax District AUCTION DATE. Your Rights as a CT Taxpayer. Groceries prescription drugs and non-prescription.

Most transactions of goods or services between businesses are not subject to sales tax. Known as marketplace facilitators these large companiesincluding Amazon and. Fraud Phishing and Identity Theft.

Newspapers and magazines whether sold in print or online are exempt from sales tax. This search covers all domestic formed in Connecticut and foreign formed outside of Connecticut entities on record. Corporation Business Tax Income Tax Trust Estate Pass Through Entity.

Create a Tax Preparer Account We cover more than 300 local jurisdictions across Alabama California Colorado Kansas Louisiana and Texas. The states annual Sales Tax Free Week which runs through Aug. This webpage contains copies of public notices issued by certain Connecticut municipalities relating to auctions they have slated to collect unpaid taxes and other charges under Connecticut General Statutes 12-157.

Using Back Button of the browser that is not understood by the CT Taxpayer Service Center application. Not everything sold electronically will be subject to the 635 rate. You can process your required sales tax filings and payments online using the official Connecticut Taxpayer Service Center website which can be found here.

South Glastonbury CT Sales Tax Rate. The new law applies to companies that do 250000 or more in annual business in Connecticut and have at least 200 separate transactions here each year. ALL ATTENDEES MUST BRING THIS COMPLETED FORM.

The acts requirements generally apply to online marketplaces that facilitate at least 250000 in sales for marketplace sellers collect Connecticut not only imposes a state income tax which is a tax levied by the state on your income earned within the state or as a resident of ct but many other types of taxes including ct property tax sales tax and. No matter if you live in Connecticut or out of state charge a flat 635 in sales tax to your customers in Connecticut. A new Connecticut law requires larger online retailers to add sales taxes to purchases beginning Dec.

South Britain CT Sales Tax Rate. Connecticut Department of Revenue Services - Time Out. 2022 Connecticut state sales tax.

The same goes if you have nexus in Connecticut because you sell on FBA. Visit myconneCT now to file pay and manage the following tax types. Sales and Use Taxes - If you sell goods or taxable services in Connecticut you may be required by law to charge and collect Connecticut sales tax.

14 2021 at 1107 am. Sales and Use Business Use Room Occupancy B. Tax suspended for one week in August for sales of clothing or footwear of less than one hundred dollars.

Exact tax amount may vary for different items. You should have received credentials to access your Connecticut Taxpayer Service Center account when you applied for your Connecticut sales tax license. Business and Bulk Filers must use myconneCT to file pay and manage the following tax types.

Room Occupancy B. The sales tax rate ranges from 0 to 16 depending on the state and the type of good or service and all states differ in their enforcement of sales tax. Sales and Use Business Use.

If you register online a temporary Connecticut sales tax permit will be available immediately. MyconneCT is the new online hub for business tax needs. Somersville CT Sales Tax Rate.

Any seller which conducts business and has a major presence within the state must collect sales tax in Connecticut must pay taxes to the state. Enter business name business ALEI or filing number. South Coventry CT Sales Tax Rate.

And charges for access to online professional or academic research databases remain taxable at the 1 rate. Please go to Connecticut Taxpayer Service Center to re-login to the system. Now you can file tax returns make payments and view your filing history in one location.

How to request copies of returns LGL-002. How to request a Ruling. On May 13 2022 LOCATION.

Either your session has timed-out or you have performed a navigation operation Ex. By not doing so the business may face sanctions or other types of penalties. We apologize for any inconvenience.

860-297-5962 Home CTgov Home Affirmative Action Login. Sherman CT Sales Tax Rate. Therefore these sellers required to file for a Sales tax certificate.

This will include all online businesses. The Connecticut state sales tax rate is 635 and the average CT sales tax after local surtaxes is 635. Ct sales tax online.

For more information or if you have any questions please contact the IT Team at 8801278050 There will be scheduled downtime across our network from 14052022 1000 Hrs to 14052022 2000 Hrs. AP Connecticut shoppers are poised to get a one-week tax break beginning Sunday. Home - Connecticut Tax Sales.

Pullman Comley 850 Main Street 8th Fl Bridgeport CT. Unlike VAT which is not imposed in the US sales tax is only enforced on retail purchases. 11 Stonegate Drive 11 Torrington CT ignore datelocation in this form Rescheduling Notice.

Wwwctgov 860-297-5962 5 REGISTRATIONS 860-263-5700 or 860-263-5151. 450 Columbus Blvd Suite 1 Hartford CT 06103 Phone. For tax preparers CPAs and filing practitioners who manage multiple business accounts for multiple clients.

Several examples of exceptions to this tax are certain types of safety gear some groceries certain types of clothing childrens car seats childrens bicycle helmets college textbooks compact fluorescent light bulbs most types of medical equipment. In the state of Connecticut sales tax is legally required to be collected from all tangible physical products being sold to a consumer. A1 From the third Sunday in August until the Saturday next succeeding inclusive during the period beginning July 1 2004 and ending June 30 2015 the provisions of this chapter shall not apply to sales of any article of clothing or footwear intended to be worn.

Looking for something specific. Simsbury CT Sales Tax Rate. College textbooks sold in print or online are also exempt from tax.

Somers CT Sales Tax Rate. This is because we are performing work on functionsparts of the network.

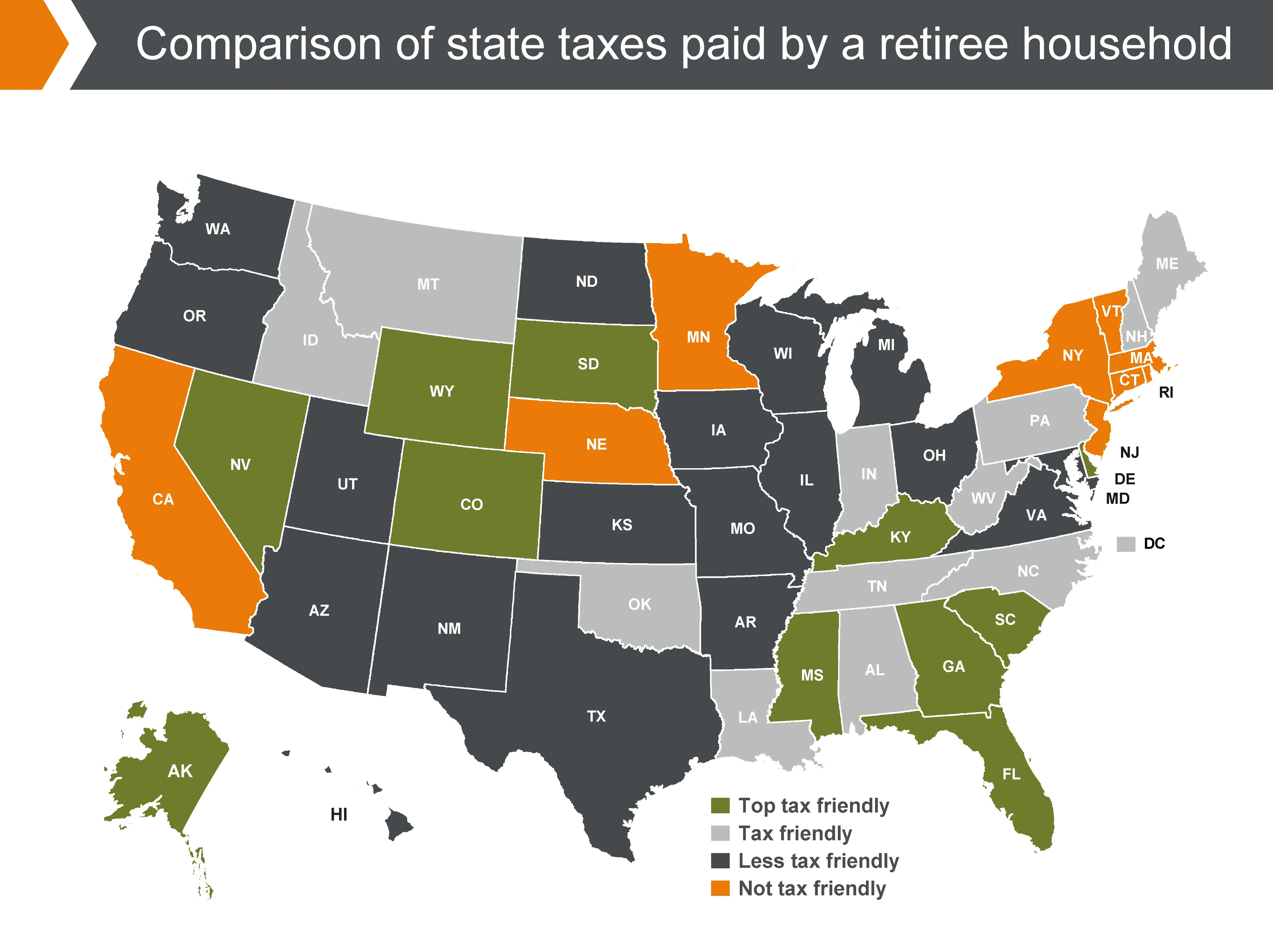

Should You Be Charging Sales Tax On Your Online Store Retirement Income Income Tax Tax Free States

States With The Highest And Lowest Taxes For Retirees Money

What German Households Pay For Power Clean Energy Wire

Connecticut Sales Tax Handbook 2022

States With Highest And Lowest Sales Tax Rates

Do You Have To Pay Sales Tax On Internet Purchases Findlaw

How To Calculate Sales Tax For Your Online Store

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Tax Guide For Online Courses

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Sales Tax Guide For Online Courses

Sales Tax Guide For Online Courses

Connecticut Sales Tax Guide And Calculator 2022 Taxjar

Sales Tax Guide For Online Courses

Should You Be Charging Sales Tax On Your Online Store Backoffice