oregon statewide transit tax rate

The tax is one-tenth of one percent 0001 or 1 per 1000 of wages. How to figure the transit tax.

Employers that expect their statewide transit tax liability to be less than 50 per year may request to file and pay the tax annually instead of quarterly.

. Two Oregon local transit payroll taxes administered by the state are to have their rates increase for 2022 the state revenue department said. The transit tax will include the following. The Oregon transit tax is a statewide payroll tax that employers withhold from employee wages.

The tax rate is 010. The statewide transit individual STI tax helps fund public transportation services within Oregon. The daily rate is 00164 percent 0000164.

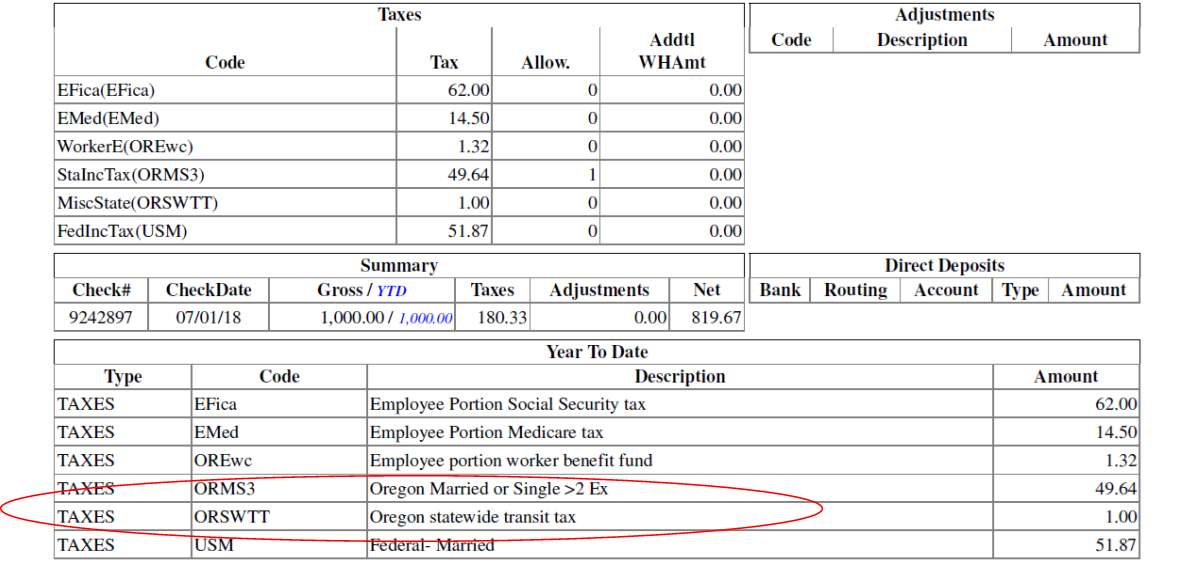

Click the Formula button and then enter the tax formula information. Starting July 1 2018 youll see a new item on your paystub for Oregons statewide transit tax. Go to the Reports tab and select Employees Payroll.

When you set up the Oregon local taxes in QuickBooks Desktop the system automatically adds the Oregon Statewide Transit Tax rate which is 01. Oregon employers must withhold 01 0001 from each employees gross pay. The Tri-County Metropolitan Transportation District Tri-Met tax rate is to increase to 07937 from 07837 and the Lane County Mass Transit District LTD tax rate is to increase to 077 from 076.

Wages of nonresidents who perform services in Oregon. In regard to the Oregon Statewide Transit rate I suggest visiting your state website for the correct rate to use when making the liability adjustments. Employers are also required to withhold the Oregon statewide transit tax of 01 from the wages of 1 Oregon residents regardless of where the work is performed and 2 nonresidents who perform services in Oregon.

Withhold the Oregon transit tax from Oregon residents as well as nonresidents who perform services in Oregon. The state transit tax is withheld on employee wages via tax code ORTRN. Select State Transit from the Special Reporting Tax Type list.

The tax is not related to the local TriMet transit payroll tax see below for info on local Oregon transit taxes. More information is available here. The tax is one-tenth of one percent 001or 1 per 1000.

Your employer will be automatically withholding the taxjust like the personal income taxso you. Heres how to do that. Wages of Oregon residents regardless of where the work is performed.

The Oregon statewide transit tax rate remains at 01 in 2022. Currently QuickBooks Desktop doesnt have the ability to e-file the Oregon Transit Tax form. What wages are subject to the Oregon statewide transit tax.

Oregon Statewide Transit Individual Tax Payment Voucher and Instructions Page 1 of 1 150-101-072. The statewide transit tax requires employers to with-hold the tax one-tenth of 1 percent or 001 from. Interest is charged daily starting the day after the due date.

If an employee is an Oregon resident but your business isnt. Heres how to figure interest. Department regulations require employers to report the Oregon statewide transit tax in Box 14 of Form W-2 with the designation ORSTT WH for example ORSTT WH - 1500.

Signature Date Phone Title X. Lets run a Payroll Detail Review report to check your employees tax deductions. Make your pay - ment using the payment coupon Form OR-OTC-V or through the departments electronic fund transfer EFT.

01 Date received Payment received Submit original formdo not submit photocopy Place a 0 in the subject wages box if the employer is subject to the tax but there was not payroll this quarter. Cigarette and tobacco products tax. 2017 which included the new statewide transit tax.

Revenue from the statewide transit tax will go to expanding public transportation throughout Oregon. The Oregon transit tax is a statewide payroll tax that employers withhold from employee wages. Your transit tax is reported quarterly using the Ore- gon Quarterly Tax Report Form OQ.

The annual interest rate is 6 percent 006. For EFT information call 503-945-8100 option 4 then option 1. The statewide transit tax is calculated based on.

Summary A Statewide transit tax is being implemented for the State of Oregon. Oregon withholding tax tables. Oregon employers must withhold 01 0001 from each employees gross pay.

For more information on how the tax revenues will be used check out HB 2017 Funding Package un der Projects News on the Oregon Department of. In the Tax Year column of the grid enter the tax year and in the Status column select All Statuses. Click the Status and Rates tab.

Oregon Quarterly Statewide Transit Tax Withholding Return Office use only Page 1 of 1 150-206-003 Rev. I also suggest following the resolution provided by ShiellaGraceA. Transient lodging administration page.

Choose Payroll Detail Review.

Oregon Transit Tax Procare Support

Ezpaycheck How To Handle Oregon Statewide Transit Tax

Oregon Transit Tax Procare Support

What Is The Oregon Transit Tax How To File More

Ezpaycheck How To Handle Oregon Statewide Transit Tax

What Is The Oregon Transit Tax How To File More

Oregon Transit Tax Procare Support